Create your financing certificate

Sellers and real estate agents look for the best prospects. With the financing certificate, you show that you have already dealt with the financing - a decisive advantage to set yourself apart from other buyers.

- 100% free

- Created in just 3 minutes

- More than 700 banks compared

- No strings attached

What is a financing certificate and why is it important for buyers?

A financing certificate confirms that you have already done a lot of research on real estate financing and that you can afford the property in principle. However, it is a preliminary assessment: further information is needed for a binding offer, as the bank will evaluate the property and request additional documents. Nevertheless, the certificate of financing is an important first step that signals to both sellers and brokers that you are in a good financial position.

Advantages of a certificate of financing when buying a property

A certificate of financing offers numerous advantages that can help you buy a property:

- Inspire confidence in sellers: It shows sellers that you have already thought about the financing of the property. This gives them assurance that you are seriously interested and have the financial means to complete the purchase.

- Advantages over other prospective buyers: With a financing certificate, you stand out from other prospective buyers. Sellers often prefer buyers who can already provide financial confirmation, which gives you a decisive advantage.

- Free and quick to issue: A financing certificate is usually free of charge and takes only a few minutes to issue. You can conveniently apply for it online, which saves you time and effort.

Important: The certificate is in German

Please note that the final buyer’s certificate will be issued in German. This ensures it meets the expectations of sellers and real estate agents in Germany, making it easier to use during the purchasing process. There’s no need to worry about the language—this is standard practice to align with local requirements.

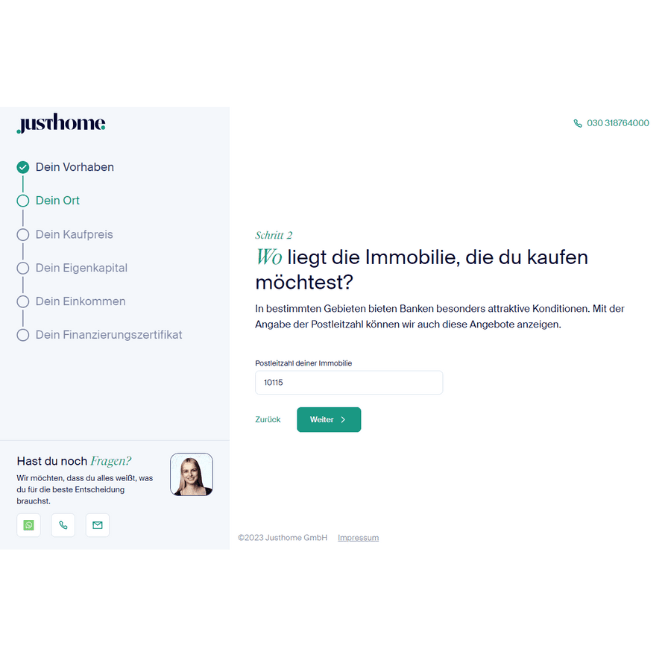

The process of applying for a financing certificate

1. Online application and requirements

To apply for a financing certificate, you start with a simple online application. This process usually only takes about 3 minutes. You provide basic information about yourself and your purchase plans, including details of your income and how much equity you would like to contribute to the financing.

2. Required documents and information

To apply, you will need the following information

- Type of project (e.g. purchase, new construction, modernization)

- Postal code of the property

- Purchase price of the property

- Equity you wish to contribute

- Monthly net household income

This information helps to create your personalized financing certificate.

3. Preliminary financing check and what happens next

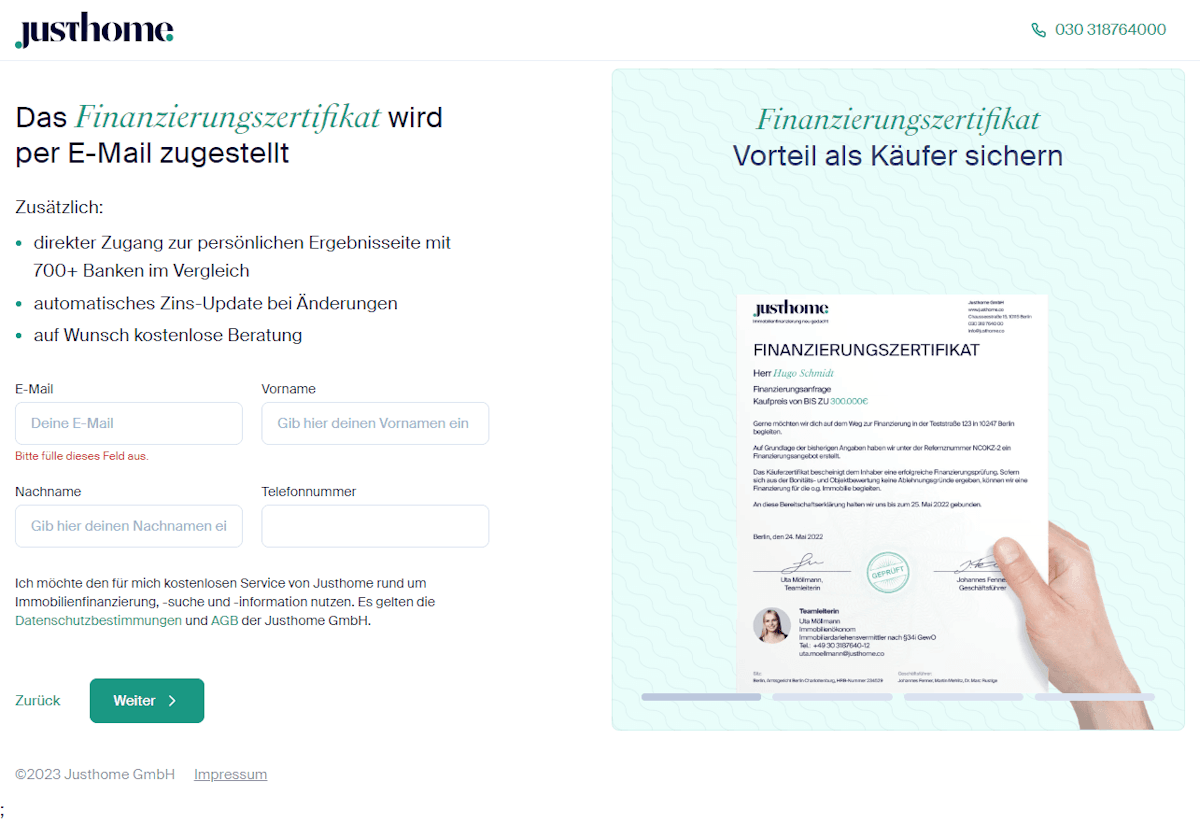

After you apply, a preliminary financing check is carried out. This is a quick check to see if your information is plausible. If everything is in order, you will immediately receive your financing certificate by email. This certificate shows sellers that you can basically afford the property and increases your chances of being shortlisted as a potential buyer.

How to get your financing certificate

Follow these three simple steps.

Would you like to know how much property you can afford?

Even if you have not yet found a specific property to buy, you can easily calculate your personal purchase budget using our budget calculator for property purchases.