Afford more, own sooner

Don't have much savings? Don’t sweat it. We create responsible, personalised financing solutions to make your new home more accessible.

Saving enough cash to buy a home is hard

Because housing prices in Germany have risen so much faster than nominal earnings, it’s harder than ever to save enough money for your down payment. This leaves many would-be homebuyers with a gap between the amount of cash they have and the amount the bank requires to procure a mortgage.

- 84%increase in the overall price of housing in Germany since 2010

- 8.17xincrease in the gap between earnings & housing prices since 2010

Boost removes the down payment barrier

When you have a reliable income, you should be able to afford a home even if you don’t have tons of cash for a down payment. We solve this problem by crafting personalised financing solutions to help you get the money you need to procure your mortgage.

Purchase sooner

Boost your budget and start enjoying your new home sooner. It can make a lot of sense to buy a few years earlier with less savings.

Explore flexible solutions

Explore different boost options to reach your homeownership goals. It’s not always about more debt. Your friends & family might also get involved.

Receive expert guidance

Get advise from our seasoned professionals with 100% transparency. They are here to help when you need them.

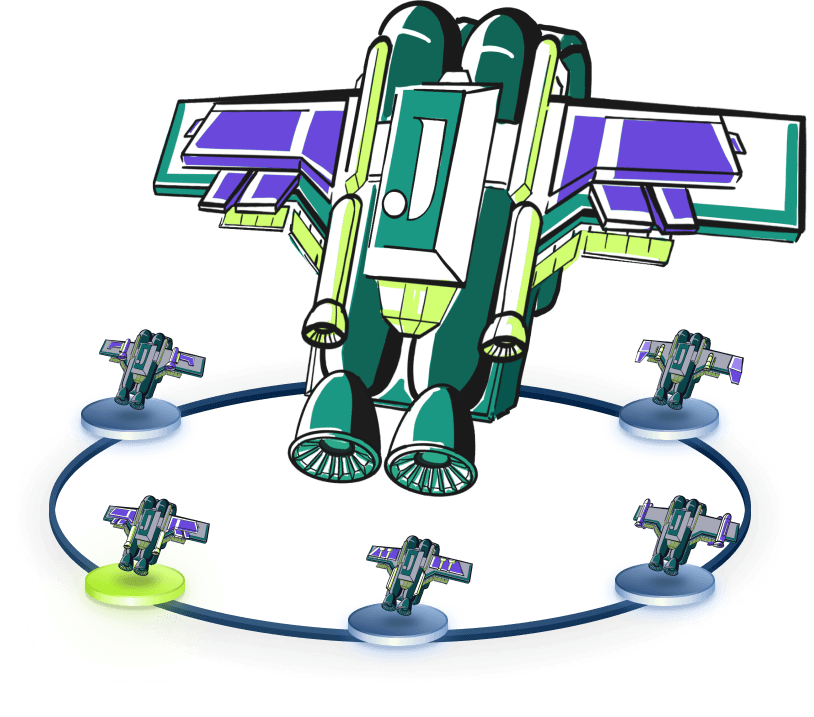

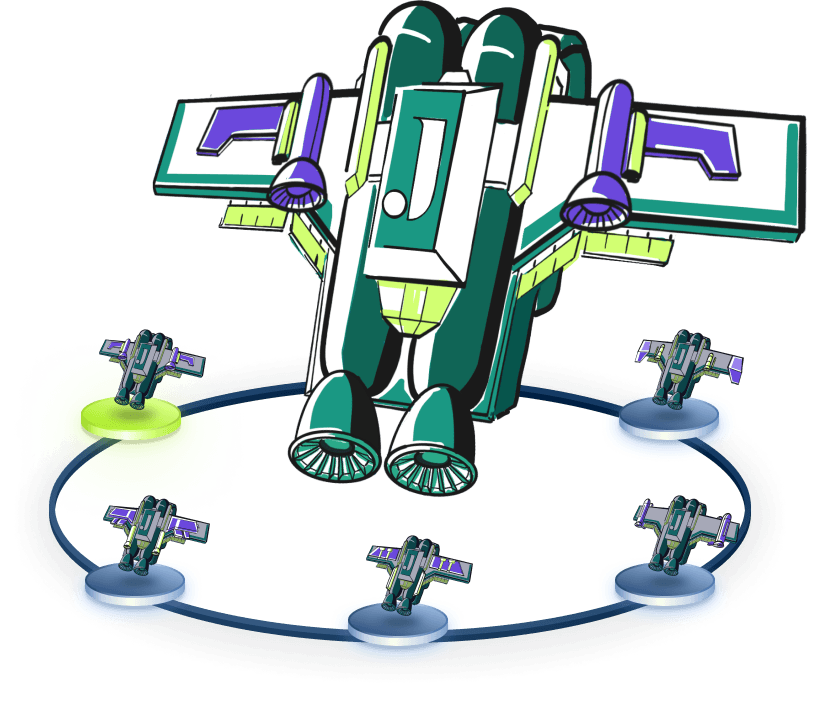

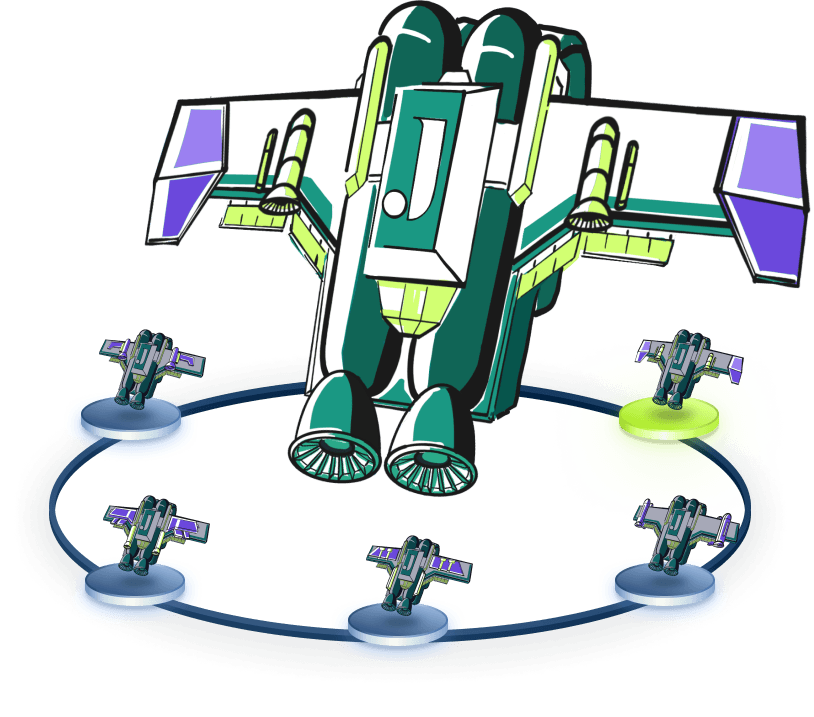

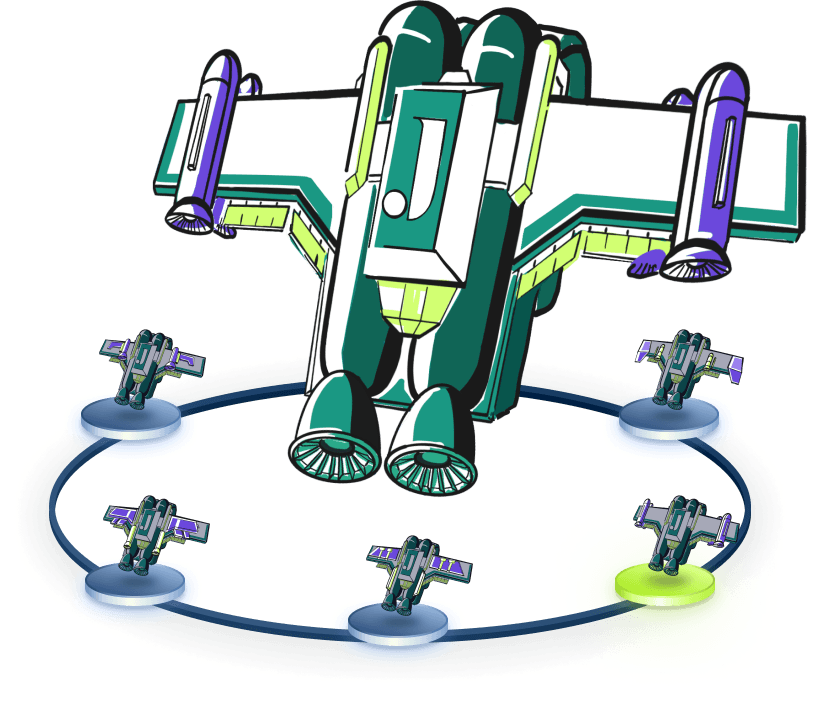

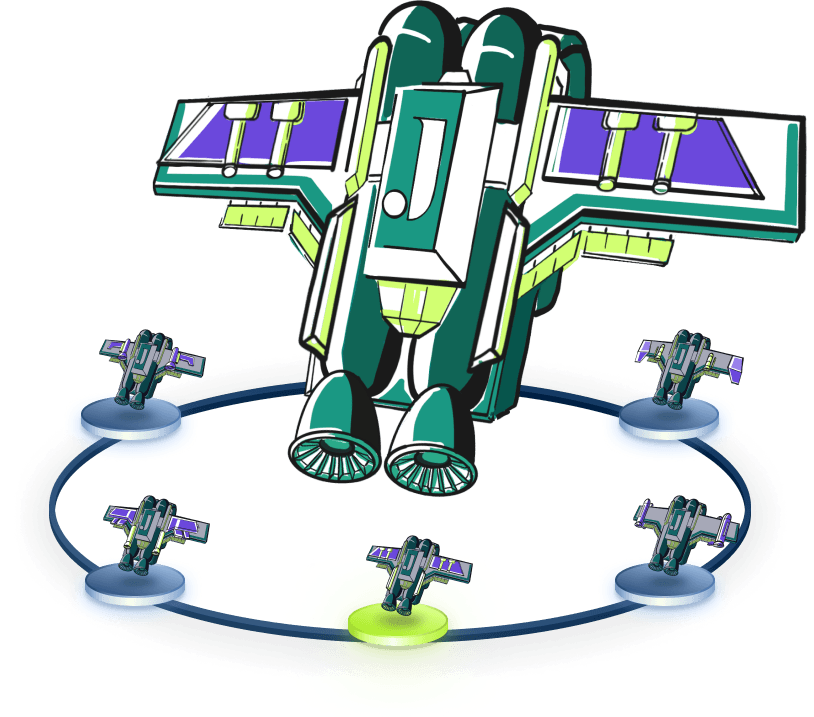

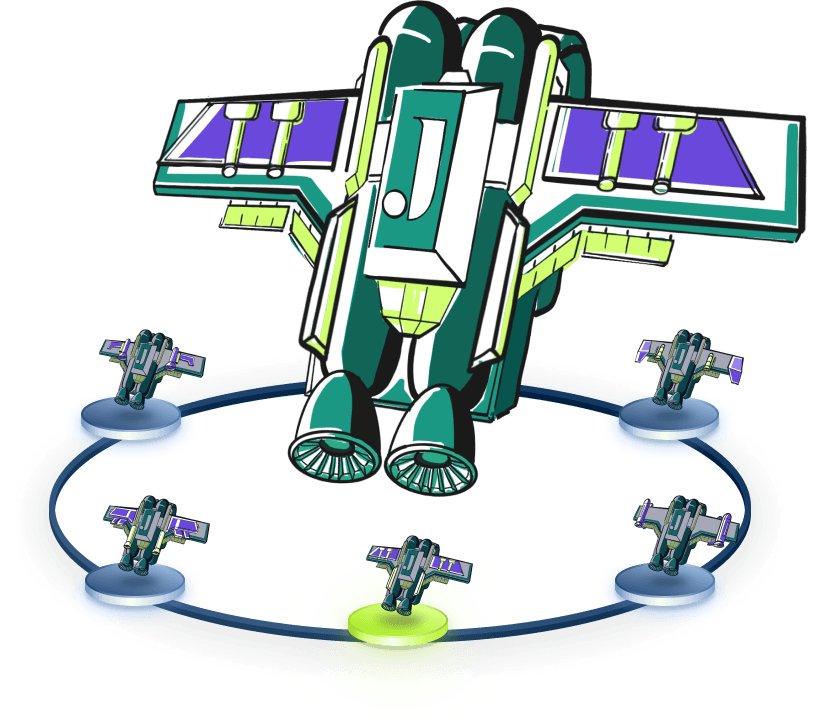

Choose the Boost solutions that work for you

Here are 5 of the most common and effective ways to bridge the gap between your savings and necessary down payment:

Understand how boost works

Chat with a mortgage expert

Our experts have 42,000+ hours of experience, so they’ve seen it all. They can craft a personalised solution that covers all your needs.

We handle all the legal stuff

We have professional processes that handle all the legal nuances. So you can rest assured your situation is handled with 100% care.

Procure your mortgage

Once we have completed all the formalities, you are approved for the amount you need and will be able to use it to get your mortgage.

Move into the home you love

There is only one thing left - to move to the house of your dreams and enjoy the life you deserve.

Get your personalised Boost financing today!

We help you boost your budget and afford your house sooner. All you have to do is book a call with a mortgage expert.

Still have questions about boost?

Here is a list of the most common questions about Boost. If you don’t find the answer to your question, our team of experts will gladly help you.